We are here to help.

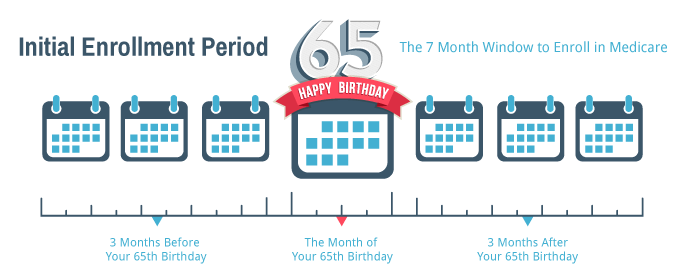

No harm in getting a jump start on the planning process to sign up for Medicare.

Plan Change Time Frames

We can help with health insurance, medicare, social security sign up and funeral planning.

Getting signed up for medicare A & B

Compare plans to fit your lifestyle–supplement and advantage plans

Offering one-on-one support

Our office, the comfort of your home, over the phone

How to sign up for Medicare: No sugar coating.

Social Security (SS) Sign Up

- Create a social security account at https://www.ssa.gov/

- Click: Sign up > My Social security > create an account. follow the steps to create an account.

Or if you already have an account, log in. - Choose whether you want to sign up for Social Security or not. If you are already on SS then you will automatically be enrolled onto Medicare. Once you take your SS that will be the lock-in point. You can sign up for both Medicare and SS, one or the other, or neither.

If you haven’t signed up to receive SS, let’s sit down and make sure it’s the right time.

Medicare Sign Up:

Original Medicare Part A (Hospital) Part B (Doctors)

- Log on to your SS account.

- Scroll down, click sign up for be Medicare. follow instructions.

Let us help you.

call us at 480-999-4409.

If you are working past 65 you can opt out of Medicare, but you should still sign up for your Medicare Part A. Your SS account will show how many quarters you worked and if you’re eligible for part A at no cost to you. When you do retire, there is a few forms to fill out proving you had health insurance, so you don’t get hit with any penalties for starting your Medicare part B and D later.

Medicare Monthly Premium Set Up

- Once you receive your Red White and Blue Medicare card from the Social Security Office, Log on to Medicare.gov to create an account.

- Add your Medicare and personal information. Make sure to save your log in and password.

- Once you have created an account, log in.

- Scroll to pay for Medicare.

If you signed up for Social Security, click that link. If you haven’t, then you will want to set up your EFT withdraw from you bank account.

If you have questions, call us at 480-999-4409

How Medicare Works Overview

Part A has a $445 monthly premium If you didn’t pay into Medicare, but if you did then it is $0 monthly.

Part B has a $170 monthly premium as of 2022.

Medicare is 80/20 your responsible for the 20% Medicare doesn’t cover.

You have 3 options for this:

- Pay the 20%

- Get a Medicare Part C / Medicare Advantage Plan (usually includes Part D). Generally, $0 monthly premium Turing the 20% cost share into copayments for service.

- Get a Medicare Supplement Plan (Medigap) and a Part D Plan. Annual increasing monthly payment (starting at $120ish at 65) to cover the 20% cost share plus the monthly premium for the Part D Plan, average $33 month.

You get Parts A and B at sign up on one card, the RED WHITE and BLUE Card.

You will need a Part D (Drug plan), Part C (Medicare advantage), or Medicare Supplement plans are optional.

Penalties

There are penalties for not taking parts A B D when you are eligible.

Part A Penalty – Additional 10% of the premium for twice the number of years enrollment was delayed.

Part B Penalty – Additional 10% of the premium for each full 12-month period enrollment is delayed.

Part D Penalty – Additional .33 cents for each month you delay enrollment.

You may delay enrolling in Medicare without penalty if you qualify for Extra Help or have creditable drug coverage.

Licensed Medicare Advisor

To set up one of the optional plans that covers the 20% and/or the Part D plan, you need a Licensed Medicare Advisor.

We at Arizona Medicare & Insurance Solutions are Full-Service Medicare Advisors. We work with the different Medicare Insurance Companies and know there is not a once size fits all.

There are 2 Different types of agents:

Type 1: Full-Service Medicare Advisors (us) are CMS certified and bound by Compliance. These agents can help you with Advantage, supplement, and part D plans.

Type 2: Medigap agents have 0 (ZERO) compliance, bother you day and night. They can only sell supplement/medigap plans and push the heck out of them.