Working with each AZ resident to help them find the right Medicare plan that fits their personal needs.

We will answer any questions you may have, and help you fully understand the plan of your choosing.

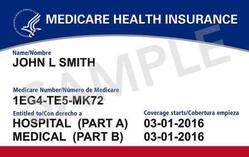

What is Medicare?

Medicare is a federally administered health insurance program providing health coverage to nearly 55 million Americas above the age of 65 and other individuals who are eligible to certain illnesses or disabilities.

Who is eligible for Medicare?

U.S. citizens and legal residents

Legal residents must live in the U.S. for at least 5 years in a row, including the 5 years just before applying for Medicare

You must also meet one of these following requirements:

- Age 65 or older

- Younger than 65 with a qualifying disability

- Any age with a diagnosis of end-stage renal disease or ALS

Medicare Coverage Choices

Step 1

Enroll in Original Medicare

Step 2

Add Additional Coverage

Medicare Advantage

Medicare Supplement/Medigap

Dual Medicare Plans

Part D Perscription Drug

Funeral Insurance

Medicare Advantage

Medicare Part C: Medicare Advantage

Medicare Part C or Medicare Advantage. Medicare Advantage plans combine Part A and Part B benefits into one plan. Most include prescription drug coverage Part D and offer additional benefits (vision, dental, hearing etc) as well, often with no monthly premium. Medicare Advantage plans are offered by private insurance companies approved by Medicare. Coverage and costs beyond the standards set by Medicare may vary from plan to plan.

Medicare Supplement/Medigap

Medicare Supplement/Medigap

Medicare supplement insurance, or Medigap, is private insurance that helps pay for some of the out‑of‑pocket costs not paid by Original Medicare (Part A and Part B). Supplement plans are medically underwritten, based on age and health to determine eligibility and monthly premiums. There are ten plans standardized by the federal government. Each is labeled with a letter. All plans with the same letter offer the same benefits. Massachusetts, Minnesota and Wisconsin have different plans.

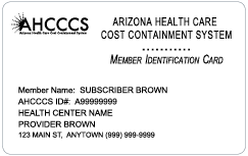

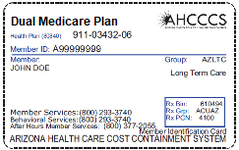

Dual Medicare Plans

Dual Medicare Plans

Do you have Medicare Parts A & B?

Do you have AHCCCS/ALTCS (Medicaid)?

If you have both Medicare and AHCCCS/ALTCS (Medicaid), you may be able to get this plan.

Dual Medicare Plan works together with your AHCCCS/ALTCS (Medicaid) plan to offer you more health coverage. You’ll keep all your AHCCCS/ALTCS (Medicaid) benefits. Plus, you could get many extra benefits and features at no extra cost. If you have both Medicare and AHCCCS/ALTCS (Medicaid), you may be able to get this plan.

Take advantage of more benefits and features at no extra cost.

Over-the-counter catalog Money to purchase items such as incontinence, vitamins, shampoo..

Dental Coverage & money to pay for dentures and dental work

Vision Coverage – Money to help buy glasses

Part D Perscription Drug

Medicare Part D: Prescription Drug Coverage

You can get prescription drug coverage as a standalone Part D plan or with a Medicare Advantage plan that includes prescription drug coverage.

There is a penalty for not signing up for Part D when it is first available to you.

Funeral Insurance

Funeral Insurance

Taking the time to arrange your funeral now leaves one less thing your loved ones will need to worry about once you’ve passed. We are here to help you every step of the way.

While people spend months planning events like weddings and trips, few think about the one event that is certain to happen: their funeral. While most people do not want to think about their own mortality, the time to pre-plan your funeral is now. The primary advantage of pre-arranging your funeral is to relieve the burden on your loved ones in an emotional time, and to ensure your funeral is carried out according to your wishes, eliminating the task of second-guessing what you would have wanted. Pre-planning and pre-paying your funeral is one of the most thoughtful gifts you can give to your family.

Pre-Payment Options

Pre-paying for your funeral reduces stress and financial burden on your loved ones after your passing. We can co-ordinate a payment plan that suits your needs. Options include a single payment plan, to monthly bank account withdrawals. By pre-paying your funeral, you ease the financial impact on your family. Pre-payment also protects you and your family, from inflation, and the growth is non-taxable. Depending on your region, if your funeral costs less than the amount you have put aside, those funds will be refunded back to your beneficiaries. For more information on what is applicable in your region, simply speak to your funeral director. Each year thousands of people decide to pre-plan and pre-pay for their funeral. These plans are designed to be flexible and to accommodate the many changes that often occur in people’s lives.

What you can do in advance

- Decide on Burial or Cremation and your casket or urn type.

- Pick what type of service you want (religious, military, non-traditional)

- Choose which funeral home to use.

- Designate your pallbearers, pick any music or readings you want at your service.

Benefits of Pre-Planning

Between 70 and 75 decisions are made within the first 24-48 hours of death. It’s difficult to think rationally while making so many decisions within days of losing someone. Pre-planning gives yourself, family, and friends peace of mind.

It’s easy. Anyone can do it, and you can change your mind at any time.